<Back to Index>

- Economist John Law, 1671

- Painter Ludovico Carracci, 1555

- 1st Commander of the Cape Johan Antoniszoon "Jan" van Riebeeck, 1619

PAGE SPONSOR

John Law (baptised 21 April 1671 – died 21 March 1729) was a Scottish economist who believed that money was only a means of exchange that did not constitute wealth in itself and that national wealth depended on trade. He was appointed Controller General of Finances of France under King Louis XIV.

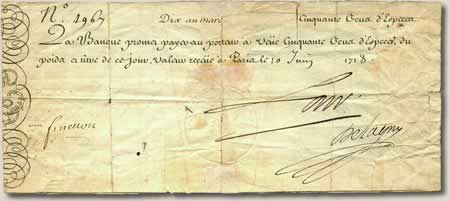

In 1716

Law established the Banque

Générale in

France,

a private bank,

but

three-quarters of the capital consisted of government bills and

government accepted notes, effectively making it the first central

bank of the nation.

He was responsible for the Mississippi Bubble and a

chaotic economic collapse in France. Law was a gambler and a brilliant mental

calculator. He was known to win card games by mentally calculating the odds.

He

originated economic ideas such as "The Scarcity Theory of Value" and the "Real

bills

doctrine". Law was

born into a family of bankers and goldsmiths from Fife;

his

father had purchased a

landed

estate at Cramond on the Firth

of Forth and was

known as Law of Lauriston.

Law

joined the family business at age fourteen and studied the banking

business until his father died in 1688. Law subsequently neglected the

firm in favour of more extravagant pursuits and travelled to London,

where he lost large sums of money in gambling. On 9

April 1694, John Law fought a duel with Edward Wilson. Wilson had

challenged Law over the affections of Elizabeth

Villiers. After Law killed Wilson, he was tried and found guilty of

murder and sentenced to death. His sentence was commuted to a fine,

upon the ground that the offence only amounted to manslaughter.

Wilson's

brother appealed and had Law imprisoned, but he managed to

escape to Amsterdam. Law urged

the establishment of a national

bank to create and

increase instruments of credit and the issue of banknotes backed by land, gold,

or silver.

The

first manifestation of Law's system came when he had returned to

Scotland and contributed to the debates leading to the Treaty

of

Union 1707. He published a text entitled Money and Trade

Consider'd with a Proposal for Supplying the Nation with Money (1705).

Law's

propositions of creating a national bank in Scotland were ultimately rejected,

and he left to pursue his ambitions abroad. He spent

ten years moving between France and the Netherlands,

dealing

in financial speculations.

Problems

with the French economy presented the opportunity to put his

system into practice. He had

the idea of abolishing minor monopolies and private farming of

taxes. He would create a bank for national finance and a state

company for commerce, ultimately to exclude all private revenue. This

would create a huge monopoly of finance and trade run by the state, and

its profits would pay off the national

debt. The council called to consider Law's proposal, including

financiers such as Samuel

Bernard, rejected the proposition on 24 October 1715. The wars

waged by Louis

XIV left the

country completely wasted, both economically and financially. The

resultant shortage of precious metals led to a

shortage of coins in circulation, which in turn limited the production

of new coins. It was in this context that the regent, Philippe

d'Orléans, appointed John Law as Controller General of

Finances. As

Controller General, Law instituted many beneficial reforms (some of

which had lasting effect, others of which were soon abolished). He

tried to break up large land-holdings to benefit the peasants; he

abolished internal road and canal tolls; he encouraged the building of

new roads, the starting of new industries (even importing artisans but

mostly by offering low-interest loans), and the revival of overseas

commerce — and indeed industry increased 60% in two years, and the number

of French ships engaged in export went from sixteen to three hundred. Since,

following the devastating War

of

the Spanish Succession, France's economy was stagnant and her national

debt was crippling, Law proposed to stimulate industry by replacing gold with paper credit and then increasing the

supply of credit, and to reduce the national debt by replacing it with

shares in economic ventures. Though they ultimately

failed, his theories were 300 years ahead of their time and "captured

many key conceptual points which are very much a part of modern

monetary theorizing".

Law

would

become the architect of what would later be known as the "The

Mississippi

Bubble"; an event that would begin with the

consolidation of the trading companies of Louisiana into a single monopoly (The

Mississippi Company), and ended with the collapse of the Banque

Generale and

subsequent devaluing of The Mississippi Company's shares. The

company's shares were

ultimately rendered worthless, and initially inflated speculation about

their worth led to widespread financial stress, which saw Law dismissed

from his post as Chief Director of the Banque Generale. Law ultimately

fled the country.

Law

initially

moved to Brussels in impoverished

circumstances. He spent the next few years gambling in Rome, Copenhagen and Venice but never regained his

former prosperity. Law realised he would never return to France when

Orléans died suddenly in 1723 and was granted permission to

return to London having received a pardon in 1719. He lived in London

for four years and then moved to Venice where he contracted pneumonia and died a poor man in 1729.