<Back to Index>

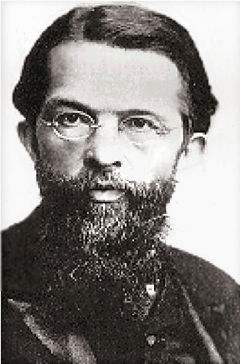

- Economist Carl Menger, 1840

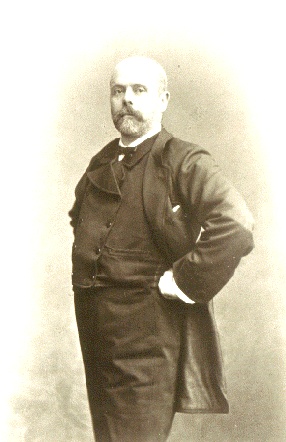

- Economist Léon Walras, 1834

PAGE SPONSOR

Carl Menger (February 23, 1840 - February 26, 1921) was the founder of the Austrian School of economics, famous for contributing to the development of the theory of marginal utility, which contested the cost - of - production theories of value, developed by the classical economists such as Adam Smith and David Ricardo.

Menger was born in Nowy Sącz in Austrian Galicia, now in Poland. He was the son of a wealthy family of minor nobility; his father, Anton, was a lawyer. His mother, Caroline, was the daughter of a wealthy Bohemian merchant. He had two brothers, Anton and Max, both prominent as lawyers. After attending Gymnasium he studied law at the Universities of Prague and Vienna and later received a doctorate in jurisprudence from the Jagiellonian University in Kraków. In the 1860s Menger left school and enjoyed a stint as a journalist reporting and analyzing market news, first at the Lemberger Zeitung in Lwów, Ukraine and later at the Wiener Zeitung in Vienna.

During the course of his newspaper work he noticed a discrepancy between what the classical economics he was taught in school said about price determination and what real world market participants believed. In 1867 Menger began a study of political economy which culminated in 1871 with the publication of his Principles of Economics (Grundsätze der Volkswirtschaftslehre), thus becoming the father of the Austrian School of economic thought. It was in this work that he challenged classical cost - based theories of value with his theory of marginality - that price is determined at the margin.

In 1872 Menger was enrolled into the law faculty at the University of Vienna and spent the next several years teaching finance and political economy both in seminars and lectures to a growing number of students. In 1873 he received the university's chair of economic theory at the very young age of 33.

In 1876 Menger began tutoring Archduke Rudolf von Habsburg, the Crown Prince of Austria in political economy and statistics. For two years Menger accompanied the prince in his travels, first through continental Europe and then later through the British Isles. He is also thought to have assisted the crown prince in the composition of a pamphlet, published anonymously in 1878, which was highly critical of the higher Austrian aristocracy. His association with the prince would last until Rudolf's suicide in 1889 (Mayerling Affair).

In 1878 Rudolf's father, Emperor Franz Josef, appointed Menger to the chair of political economy at Vienna. The title of Hofrat was conferred on him, and he was appointed to the Austrian Herrenhaus in 1900.

Ensconced in his professorship he set about refining and defending the positions he took and methods he utilized in Principles, the result of which was the 1883 publication of Investigations into the Method of the Social Sciences with Special Reference to Economics (Untersuchungen über die Methode der Socialwissenschaften und der politischen Oekonomie insbesondere). The book caused a firestorm of debate, during which members of the Historical school of economics began to derisively call Menger and his students the "Austrian School" to emphasize their departure from mainstream economic thought in Germany – the term was specifically used in an unfavorable review by Gustav von Schmoller. In 1884 Menger responded with the pamphlet The Errors of Historicism in German Economics and launched the infamous Methodenstreit, or methodological debate, between the Historical School and the Austrian School. During this time Menger began to attract like - minded disciples who would go on to make their own mark on the field of economics, most notably Eugen von Böhm-Bawerk, and Friedrich von Wieser.

In the late 1880s Menger was appointed to head a commission to reform the Austrian monetary system. Over the course of the next decade he authored a plethora of articles which would revolutionize monetary theory, including "The Theory of Capital" (1888) and "Money" (1892). Largely due to his pessimism about the state of German scholarship, Menger resigned his professorship in 1903 to concentrate on study.

Menger used his “subjective theory of value” to arrive at one of the most powerful insights in economics: both sides gain from exchange. Unlike William Jevons, Menger did not believe that goods provide “utils,” or units of utility. Rather, he wrote, goods are valuable because they serve various uses whose importance differs. Menger also came up with an explanation of how money develops that is still accepted today. If people barter, he pointed out, then they can rarely get what they want in one or two transactions. If they have lamps and want chairs, for example, they will not necessarily be able to trade lamps for chairs but may instead have to make a few intermediate trades. This is a hassle. But people notice that the hassle is much less when they trade what they have for some good that is widely accepted, and then use this good to buy what they want. The good that is widely accepted eventually becomes money.

Léon Walras (December 16, 1834 - January 5, 1910) was a French mathematical economist. He formulated the marginal theory of value (independently of William Stanley Jevons and Carl Menger) and pioneered the development of general equilibrium theory.

Walras was the son of French economist Auguste Walras. His father was a school administrator and not a professional economist, yet his economic thinking had a profound effect on his son. He found the value of goods by setting their scarcity relative to human wants.

Walras enrolled in the Paris School of Mines, but grew tired of engineering. He also tried careers as a bank manager, journalist, romantic novelist and a clerk at a railway company before turning to economics. Walras received an appointment as the professor of political economy at the University of Lausanne.

Walras also inherited his father's interest in social reform. Much like the Fabians, Walras called for the nationalization of land, believing that land's value would always increase and that rents from that land would be sufficient to support the nation without taxes.

Another of Walras' influences was Augustin Cournot, a former schoolmate of his father. Through Cournot, Walras came under the influence of French Rationalism and was introduced to the use of mathematics in economics.

Professor of Political Economy at the University of Lausanne, Switzerland, Walras is credited for having founded what subsequently became known, under direction of his Italian disciple, the economist and sociologist Vilfredo Pareto, as the Lausanne school of economics.

Because for a long time most of Walras' publications were only available in French, only a relatively small section of the economics profession really became familiar with his work. This changed in the 1950s, largely due to the work of William Jaffé, the translator of Walras' main works, and the editor of his Complete Correspondence (1965). Walras' work was also too mathematically complex for many contemporary readers of his time. On the other hand, it has a great insight into the market process under idealized conditions so it has been far more read in the modern era.

Although Walras came to be regarded as one of the three leaders of the marginalist revolution, he was not familiar with the two other leading figures of marginalism, William Stanley Jevons and Carl Menger, and developed his theories independently.

In 1874 and 1877 Walras published Elements of Pure Economics, a work that led him to be considered the father of the general equilibrium theory. The problem that Walras set out to solve was one presented by Cournot, that even though it could be demonstrated that prices would equate supply and demand to clear individual markets, it was unclear that an equilibrium existed for all markets simultaneously.

Walras constructed his basic theory of general equilibrium by beginning with simple equations and then increasing the complexity in the next equations. He began with a two person bartering system, then moved on to the derivation of downward sloping consumer demands. Next he moved on to exchanges involving multiple parties, and finally ended with credit and money.

Walras created a system of simultaneous equations in an attempt to solve Cournot's problem "(which supposedly Walras at first thought was complete merely because the number of equations equaled the number of unknowns)"

The crucial step in the argument was Walras' Law which states that considering any particular market, if all other markets in an economy are in equilibrium, then that specific market must also be in equilibrium. Walras' Law hinges on the mathematical notion that excess market demands (or, inversely, excess market supplies) must sum to zero. This means that, in an economy with n markets, it is sufficient to solve n-1 simultaneous equations for market clearing. Taking one good as the numeraire in terms of which prices are specified, the economy has n-1 prices that can be determined by the equation, so an equilibrium should exist. Although Walras set out the framework for thinking about the existence of equilibrium clearly and precisely his attempt to demonstrate existence by counting the number of equations and variables was severely flawed: it is easy to see that not all pairs of equations in two variables have solutions. A more rigorous version of the argument was developed by Kenneth Arrow and Gérard Debreu in the 1950s.

In 1941 George Stigler wrote about Walras: "There is no general history of economic thought in English which devotes more than passing reference to his work. … This sort of empty fame in English - speaking countries is of course attributable in large part to Walras' use of his mother tongue, French, and his depressing array of mathematical formulas." What ever caused the u-turn of Walras' consideration in the US, the influx of German - speaking scientists – the German version of the Éléments is of 1881 – after Hitler's rule was the initial start. To Schumpeter: Walras is … greatest of all economists. His system of economic equilibrium, uniting, as it does, the quality of ‘revolutionary" creativeness with the quality of classic synthesis, is the only work by an economist that will stand comparison with the achievements of theoretical physics.